The release of Joint Ministerial Decision 46982/18.06.2025, stipulates the fines that will be imposed to the legal entities that are obliged to register with the General Commercial Registry (GEMI) in accordance with the L. 4919/2022, in the context of harmonization with (EU) Directive 2019/1151 of the European Parliament and of the amended (EU) Directive 2017/1132 of June 20, 2019.

Διαβάστε το κείμενο στα ελληνικά

GEMI fines are imposed on legal entities that violate the commercial disclosure obligations stipulated in the L. 4919/2022 or arising from more specific legislation, depending on the type of the company.

Entities required to register with the General Commercial Registry (GEMI) and are subject to fines are:

- Capital companies: Société Anonyme (S.A.), Limited Liability Company (LLD), Private Capital Company (PCC), European Company (Societas Europaea), and Limited Partnership with Shares.

- Cooperatives: Civil Cooperatives, which include mutual insurance, credit, and building cooperatives, Energy Communities, Renewable Energy Communities, and Citizens’ Energy Communities. In addition, the European Cooperative Society, the Social Cooperative Enterprise, and the Workers’ Cooperative under the L. 4430/2016, the Limited Liability Social Cooperative under art. 12 of the L. 2716/1999

- Partnerships: Sole Proprietorship, General Partnership/Limited Partnership

- Special Purpose entities: Joint Venture (JV), European Economic Interest Grouping (EEIG), and Civil Company under art.784 of the Civil Code

- Branches or Agencies of foreign Companies

Entities not obliged to register with GEMI:

- Civil law partnerships for the exercise of professional activities by lawyers, notaries, and judicial officers.

- Offices or branches of foreign shipping companies established in Greece, in accordance with art. 25 of the L. 27/1975 and the L.C. 378/1968.

- Shipping companies established under the L. 959/1979 and recreational vessel shipping companies (NEPA) established under L. 3182/2003.

Transitional provision

Until December 31, 2025, all entities required to register with GEMI are granted the opportunity to settle their obligations towards GEMI, without incurring any administrative penalties.

From January 1st, 2026, the competent GEMI will begin imposing fines in accordance with the following:

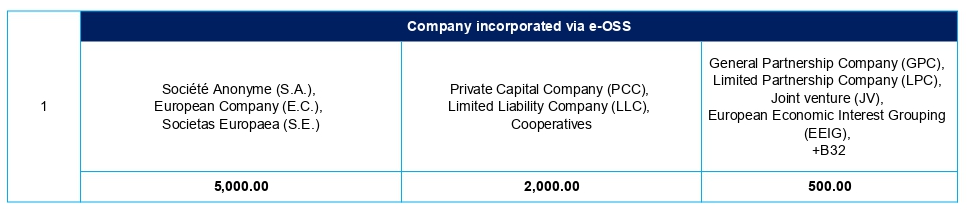

1) Infringement of art. 12 of the L. 4919/2022, concerning the register of a company through the electronic One-Stop Shop service (e- OSS).

For companies register via One-Stop Shop service (e-O.S.S.), for which no legality check was carried out by the competent One-Stop Shop authority, in the event of an infringement of the above-mentioned article, the amount of the fine shall be determined based on the legal form of the company in question, in accordance with the table below:

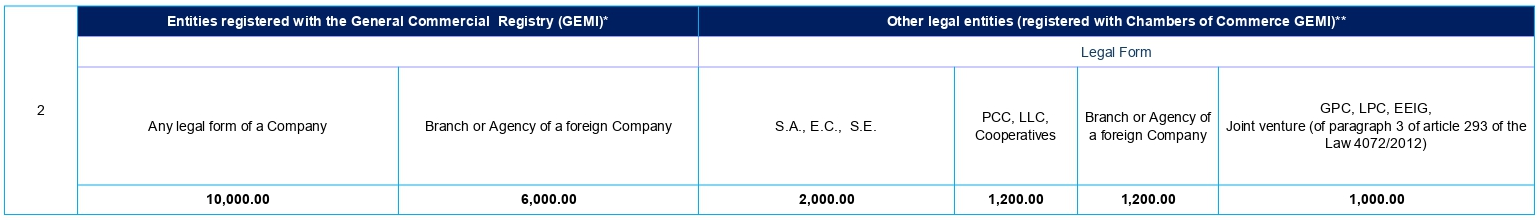

2) Infringement of art. 16 of the L. 4919/2022, regarding the failure to register with the General Commercial Registry (GEMI).

The amount of the fine for this infringement is determined based on the company’s legal form and its classification category, in accordance with the table below. It is applicable to entities that are subject to register with GEMI, but haven’t done so (including entities in active status or under liquidation, or operating a branch of a foreign company in Greece):

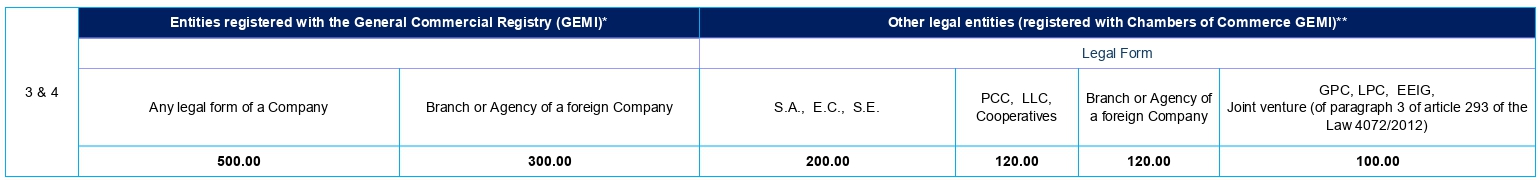

3) Infringement of art. 22 and 37 of the L. 4919/2022, regarding the omission to include the company’s or foreign branch’s required information in the corporate documents and correspondence of it.

This concerns the failure to include the required information in the correspondence and documents of the company or foreign branch (e.g. GEMI number, legal form, name, registered office of the company in liquidation, etc.). The amount of the fine is determined based on the company’s legal form and its classification category, in accordance with the table below.

4) Infringement of art. 25 of the L. 4919/2022, regarding the late submission of an application for registration with the General Commercial Registry (GEMI).

This infringement concerns the late submission of an application to GEMI for the registration and publication of information and acts, in accordance with the provisions of par.1 of art. 18 of the L. 4919/2022. The deadline is twenty (20) days from the date of the decision for domestic companies and three (3) months from the registration of the relevant decision in the national register of the parent company’s registered office for foreign branches. The amount of the fine is determined based on the legal form of the company and its classification in accordance with the table below:

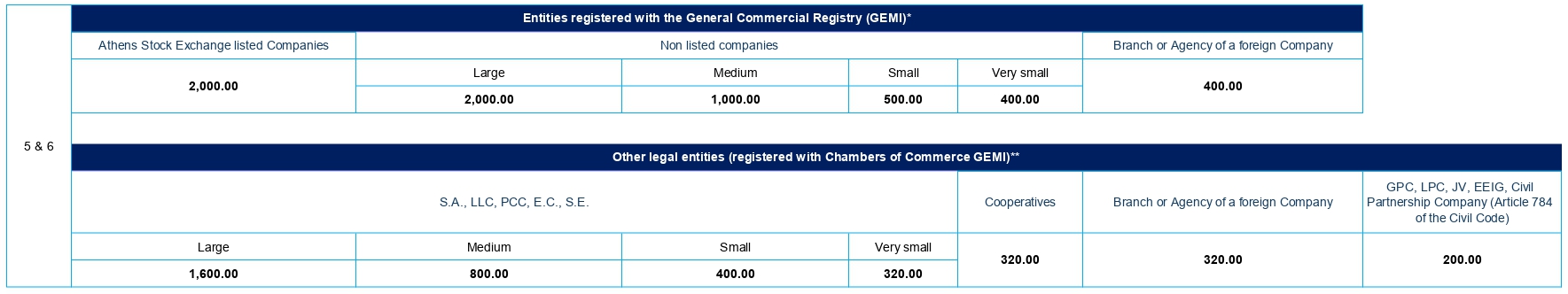

5) Infringement of art. 26 and 38 of the L. 4919/2022, concerning automatic registrations in the General Commercial Registry (GEMI).

This concerns penalties imposed for acts that are registered automatically in GEMI (e.g. registration of incomplete or incorrect data/files). The amount of the fine is determined based on the legal form and classification of the company, and in case of capital companies, is based on the size criterion, in accordance with the following tables per GEMI category.

6) Infringement of art. 30, 33, 34, 35, 39, and 43 of the L. 4919/2022, regarding the information that must be registered and published in the General Commercial Registry (GEMI)

This concerns infringements relating to the failure to submit an application for the registration and publication in GEMI of acts and information provided for, in the above-mentioned articles (e.g. articles of association, representation, etc.). The amount of the fine is determined on the basis of the legal form and the classification of the company, and in case of capital companies, is based on the size criterion, in accordance with the following tables:

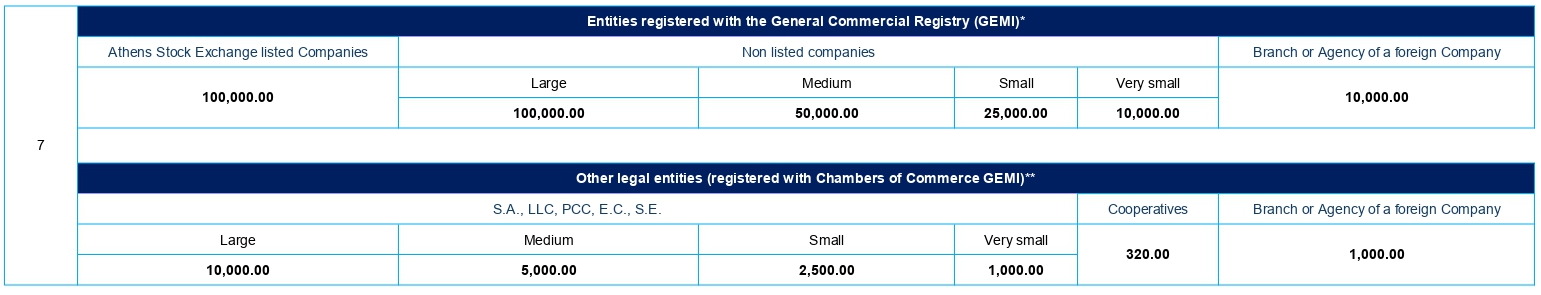

7) Infringement of point ia, of paragraph 1 of art. 34, point e, par. 1 of art. 35, point θ, of art. 39, point i, of art. 43, and art. 44 and 45 of the L. 4919/2022, regarding the omission of the publication of the financial statements

This concerns companies that are required to publish financial statements in the General Commercial Registry (GEMI) as well as the accompanying reports, within the deadlines set by the Law. This infringement does not include the opening and closing liquidation balance sheets, nor the interim financial statements. The amount of the fine is determined based on the legal form, the classification category, and the size criterion of the company in accordance with the following tables:

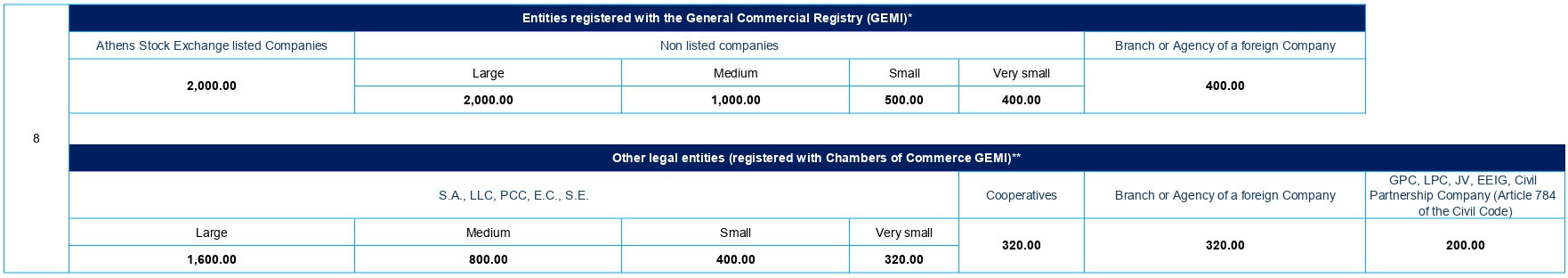

8) Infringement of art. 54 of the L. 4919/2022, regarding the company’s name and its distinctive title

This concerns the company’s name and its distinctive title when they offend public decency and did not differ from the name or distinctive title of another company registered with the General Commercial Registry (GEMI), as defined by the relevant legal provisions. The amount of the fine is determined on the basis of the legal form and classification category of the company and in case of capital companies, is based on the size criterion, in accordance with the following tables:

Ascertainment of Infringements

The ascertainment of the above-mentioned infringements is carried out ex officio by GEMI, either through notification from another authority, or following an ex officio or random check, or a complaint.

Special Cases

- For legal entities under liquidation or special liquidation proceedings, the amount of the administrative fine is reduced by fifty percent (50%).

- If, at the time the infringement is identified, the entity subject to the obligation has changed legal form, entity c classification category, or size category, the amount of the administrative penalty shall be calculated based on the criteria that were in force at the time the infringement was committed.

- In case where, at the time the fine is imposed, the first balance sheet has not yet been prepared, the size of the company shall be determined in accordance with point (ia) of art. 2 of the L. 4548/2018.

Recidivism

In the event of a recurrence of the same infringement within three years from the notification of the fine, the amount of the fine imposed shall be doubled, and in case of multiple repeated recurrences within the same period, the amount of the fine shall be tripled. That kind of information (regarding the recidivism of the obligated entity) is recorded and maintained in the electronic fine management system of GEMI.

Procedure for imposing and confirming fines

Interested parties have fifteen (15) days from the receipt of the notification, which is sent to their message inbox, to challenge the imposition of the fine, by submitting electronically an application via the electronic fine management system of GEMI and present substantiated arguments explaining the reasons why the administrative fine should not have been imposed.

The amount of the administrative fine imposed shall be reduced by fifty percent if the liable party settles the payment of it within thirty (30) days from the date of its notification and at the same time completes the required registration, update, or deletion related to the infringement of the act for which the fine was imposed. The available payment methods of the fine are published on the official website of GEMI (www.businessportal.gov.gr). Such payment constitutes an automatic and irrevocable waiver by the liable party of any right to challenge or contest the fine.

However, in accordance with the decision, the administrative fines described shall not apply to Limited Liability Social Cooperatives, Social Cooperative Enterprises, and Workers’ Cooperatives.

Finally, instructions are provided regarding the transitional period in relation to corrections and registrations of pending acts (by category of infringement of article of the L. 4919/2022), without the imposition of administrative penalties, with the explanatory circular 56823/ 18-07-2025 of the said Joint Ministerial Decision.

However, further clarifications are expected to be released from the competent authorities in relation to the above-mentioned as well as for the imposition of penalties that will be imposed from 1st January 2026.